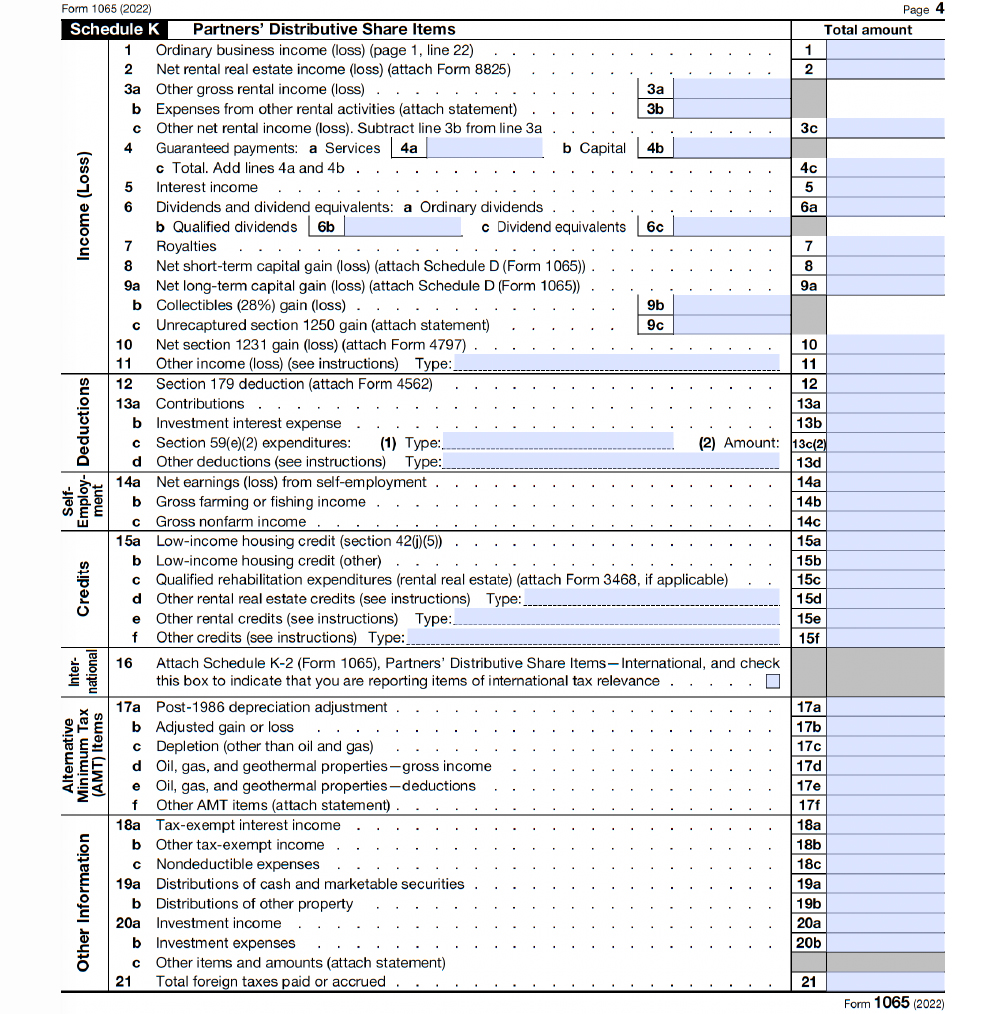

2024 Form 1065 Schedule K-12 – Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a . Once you’ve prepared Form 1065, Schedule K-1s are prepared for each partner for each month or part of a month (for a maximum of 12 months) the failure to file continues, multiplied by .

2024 Form 1065 Schedule K-12

Source : lili.co1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

Source : www.nelcosolutions.comOakley CPA PLLC | Nashville TN

Source : www.facebook.comSchedule K 1 (Form 1065) Partnership (Overview) – Support

Source : support.taxslayer.com1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

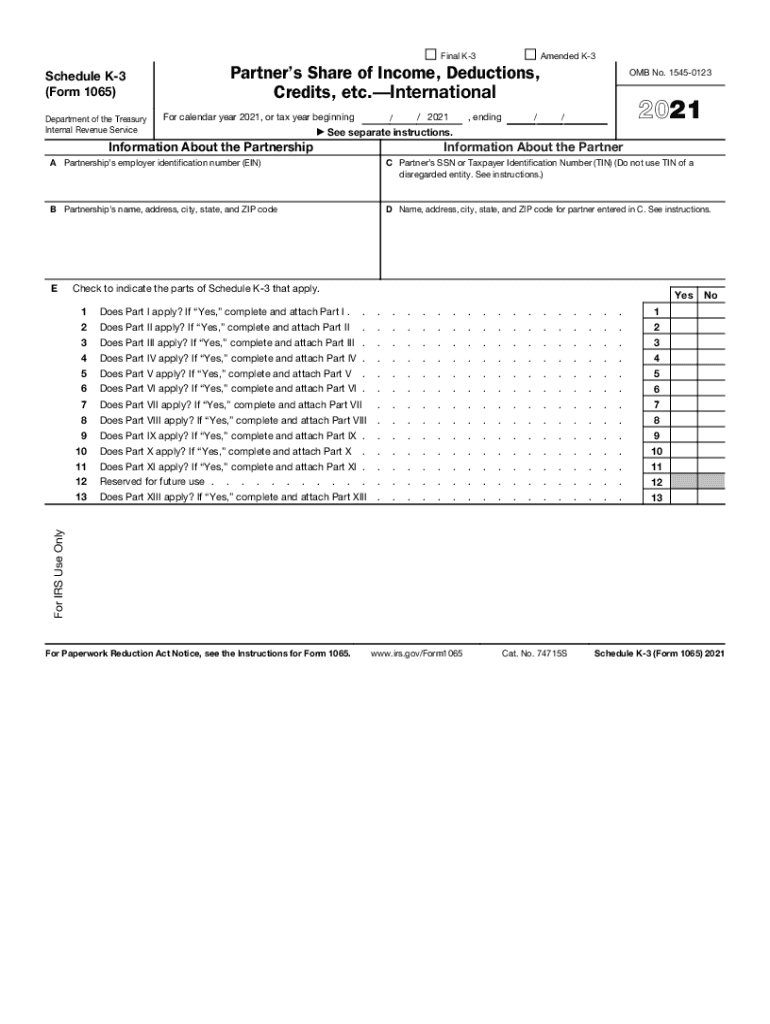

Source : www.nelcosolutions.comSchedule k 3 is attached if checked: Fill out & sign online | DocHub

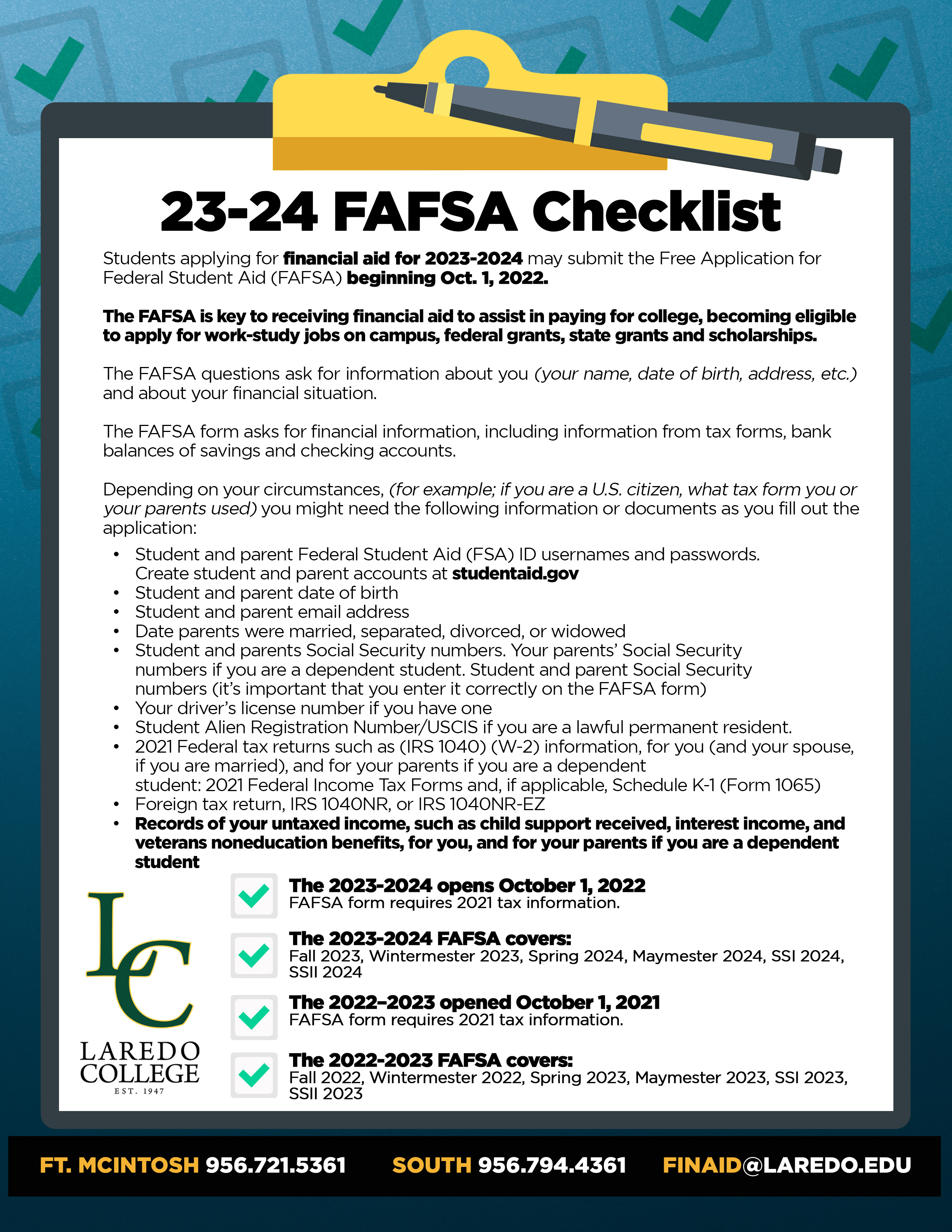

Source : www.dochub.comLaredo College on X: “Need further guidance on how to complete

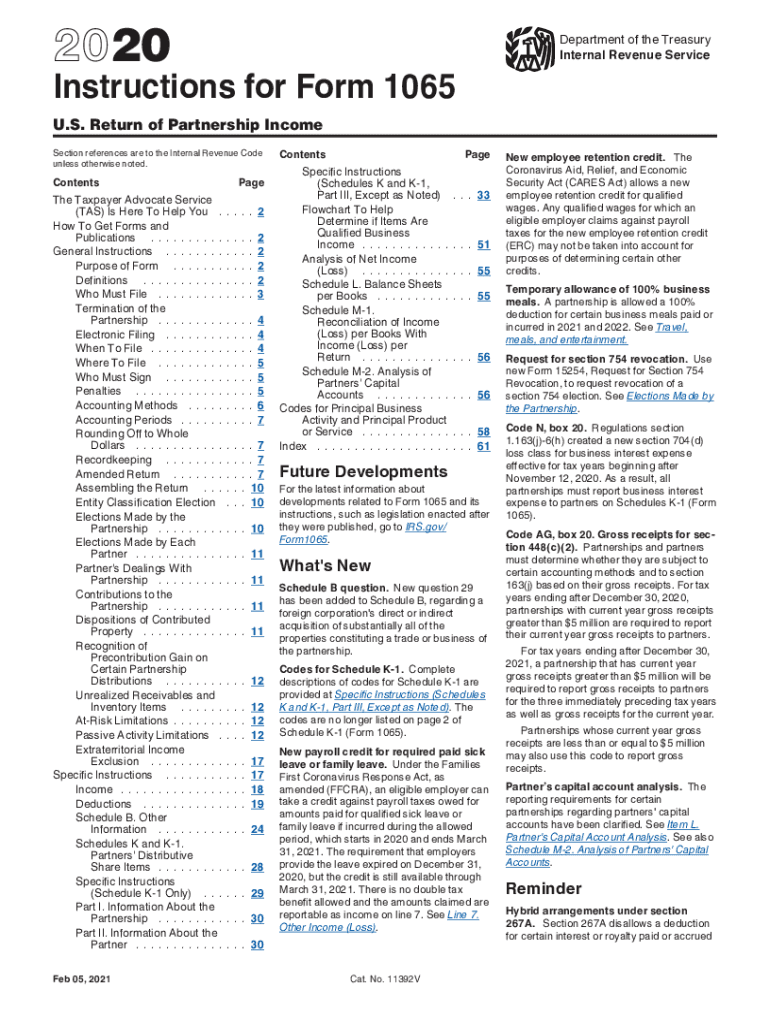

Source : twitter.comForm 1065 instructions: Fill out & sign online | DocHub

Source : www.dochub.comComplying with new schedules K 2 and K 3

Source : www.thetaxadviser.comIRS 1065 Schedule K 1 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.com2024 Form 1065 Schedule K-12 Form 1065 Instructions: U.S. Return of Partnership Income: Schedule K-1 Tax Form for Inheritance vs. Schedule K-1 (Form 1065) Schedule K-1 can refer to more than one type of tax form and it’s important to understand how they differ. While Schedule K-1 . You should continue to fill out the form just as if the partnership is ongoing and be sure to file your form 1065 Schedule K-1s to the partners. 3. Check the box located in G, 2 on Form 1065. .

]]>